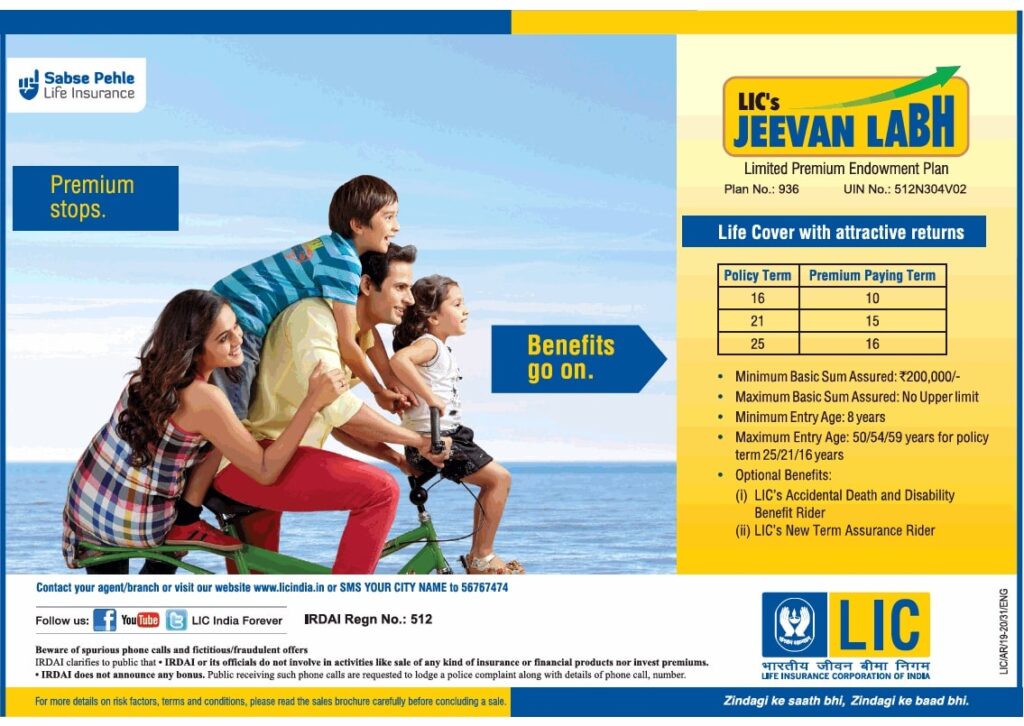

JEEVAN LABH PLAN

LIC Jeevan Labh Plan (Plan No. 936) is a Limited Premium Paying with Profits Endowment Plan which is suitable for creating a big corpus for children’s marriage purpose. Policyholder can choose to pay premium for 10 years and maturity at 16th year (Free Risk Cover for 6 years) OR Pay Premium for 15 years and Maturity at 21st year (Free Risk Cover for 6 years) OR Pay Premium for 16 years and Maturity at 25th year (Free Risk Cover for 9 years)

WHY SHOULD I INVEST IN JEEVAN LABH PLAN?

- Cover wide age group from 08 to 59 years.

- Starting Early Enables to Build a Big Corpus with Small Savings.

- To Beat Inflation.

- To Ensure Your Financial Stability in Future.

- To Achieve Your Financial Goals.

- To Ensure Financial Stability For Your Dependents.

- Short Term And Long Term Both Options Available.

- Eligible for Bonuses and Final Addition Bonuses declared by LIC.

- Term Rider Benefit Available.

- Double Accident Rider Available.

- PWB Rider is also available in this plan for minors.

- Double Tax Benefit Available (Premium Paid gives 80C Tax Benefit up to Rs. 1,50,,000 and Maturity is also Tax Free under section 10(10D)).

- Loan and Surrender Facility Available.

MATURITY BENEFIT

On completion of policy term, Sum Assured + Bonus + Final Addition Bonus will be paid as maturity.

DEATH CLAIM BENEFIT

In case of death during policy term of the plan, Sum Assured Along With Bonus and Final Addition Bonus Will Be Paid to the Nominee.

ELIGIBILITY CRITERIA FOR JEEVAN LABH PLAN

| Minimum Age to Apply | 8 Years (Completed) | |||

| Maximum Age to Apply |

|

|||

| Policy Term (Premium Payment Term) | 16(10), 21(15), 25(16) | |||

| Maximum Maturity Age | 75 Years | |||

| Premium Paying Mode | Yearly, Half Yearly, Quarterly, Monthly(ECS) | |||

| Basic Sum Assured | 2,00,000 and above (in multiple of 10,000) | |||

| Loan | After 3 years | |||

| Surrender | After 3 years of full premium payment |